- Investing in stocks over the next decade is going to get tough for those that simply buy and hold.

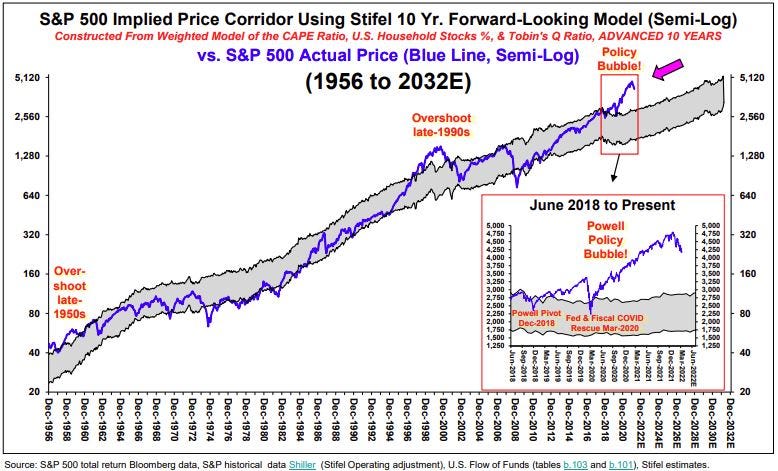

- That's according to Stifel's chief equity strategist, Barry Bannister, who foresees a lost decade for stocks.

- Here's how investors should prepare for the potential of 0% returns in the US stock market through 2031, according to Bannister.

The next decade won't be as easy as the last one was for investors in the US stock market, according to Stifel's chief equity strategist, Barry Bannister.

Instead of the S&P 500's compounded annual rate of return of more than 13% during the 2010's, investors should prepare for the likelihood of a lost decade ahead, or returns of 0% in the US stock market from the end of 2021 through the end of 2031, Bannister told Insider in an interview on Wednesday.

While that might sound crazy to the millions of investors that discovered the stock market for the first time amid the COVID-19 pandemic and were conditioned to expect new highs after every sell-off, it's not out of the question.

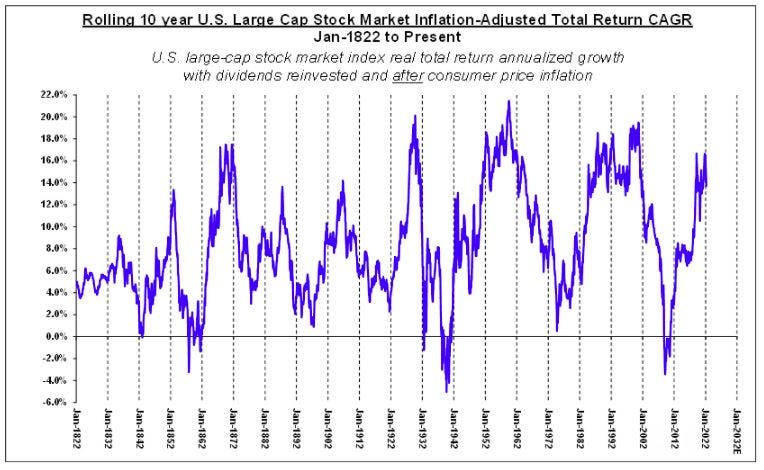

In fact, it just happened, relatively speaking, with the stock market delivering a compounded annual rate of return of -0.9% during the 2000's. That decade started at the peak of the dot-com bubble and ended near the depths of the Great Financial Crisis.

"Over two centuries, 20-year returns [in the stock market] have always been positive in both real and nominal terms…but over 10-years, you could lose money," Bannister said.

Bannister's outlook for poor stock market returns ahead is driven by elevated valuation metrics, a local high in the percentage of stock ownership among households, as well as the potential for serious geopolitical risks.

"As long as the laws of supply and demand exist, we're going to have [supply chain] disruptions, geopolitical rivalries, fiat currencies, indebted governments, populism, and [profit] margin and regulatory pressure," Bannister explained.

Some of this has already started to play out in 2022, with Russia's attack against Ukraine raising geopolitical tensions to new heights. The invasion has led to an exacerbation of supply chain disruptions and massive price rises in everything from wheat to oil to nickel.

"I would say that the locking up of Russian reserves was as big of a watershed moment as when Nixon got the US off the gold standard in 1971. This told the world that they need to find alternative reserve currencies for their assets."

If Bannister's view is correct, that could strengthen foreign currencies like the Chinese yuan at the expense of the US dollar.

Geopolitical tensions could get even worse if China invades Taiwan, which Bannister believes is a given.

"Xi Jinping is not going to die without making a try [for Taiwan]," Bannister said, noting that given his current age a move against Taiwan is likely to happen by the end of this decade. And on top of that, Iran is likely to resurface as a geopolitical hotspot in the 2020's, according to Bannister.

So how can investors eke out a positive return over the next decade? According to Bannister, simply buying and holding the S&P 500, a strategy that has done remarkably well since 2009, is not the answer.

"Buy and hold is the ideal strategy in the bull phases...but in the down phases, being in the index is not going to generate a positive return. Investors who are passive are going to suffer," Bannister said.

Instead, investors should allocate to real and alternative assets including commodities, real estate, and the more active long/short stock picking strategies often employed by hedge funds. Within the equity space, value stocks should outperform growth stocks, while international stocks are likely to outperform US stocks, according to Bannister.

In the short-term, Bannister admits there is room for upside in the S&P 500, with a potential relief rally to as high as 4,600. But those rallies should be sold rather than bought, because like in the aftermath of the dot-com bubble, a 20% counter-trend rally in the market is possible amid a broader down-trend.